Let’s talk about the Bitcoin blockchain and what happens to the bitcoin price roughly every 4 years.

I assume you understand that bitcoins are paid to transaction validators (miners) every time a new block gets added to the blockchain (about every 10 minutes). When the Bitcoin network started in 2009, miners received 50 bitcoin every time one of their blocks got added to the blockchain. Of course, back then, bitcoin wasn’t worth very much. However, regardless of the price, these miners were raking in the bitcoin, and eventually, they would rake in the dough when the bitcoin price took off. But did you know that miners’ bitcoin payments get reduced by 50% every four years?

A good question is, WHY does the bitcoin distribution get cut in half every 4 years, and what can we expect for the next halving?

Let’s start with WHY.

Cryptocurrencies get minted on either a deflationary or inflationary schedule. An inflationary supply schedule means more cryptocoins get minted regularly as determined by the developers and outlined in the whitepaper. So, bitcoin is inflationary because new coins are minted every 10 minutes.

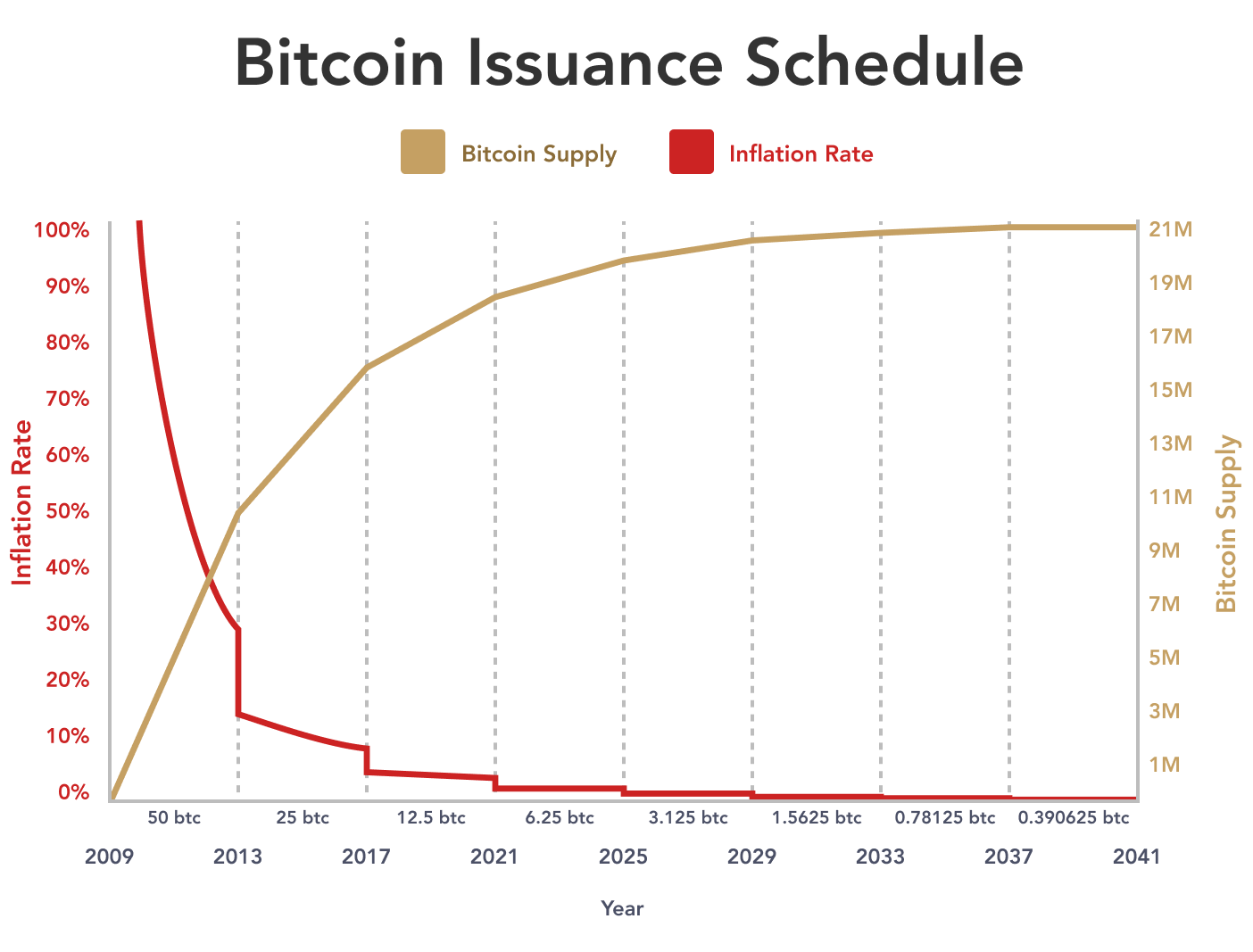

However, the inventors of Bitcoin were very wise. To keep bitcoin inflation in check, they built into the code a mechanism that reduces the supply of bitcoin by half every 4 years. This means miners receive 50% less bitcoin every four years for each block they produce. This creates a controlled declining inflationary rate.

Take a look at the bitcoin minting schedule. Note the amount of BTC minted every four years is cut in half until they’ve all been mined.

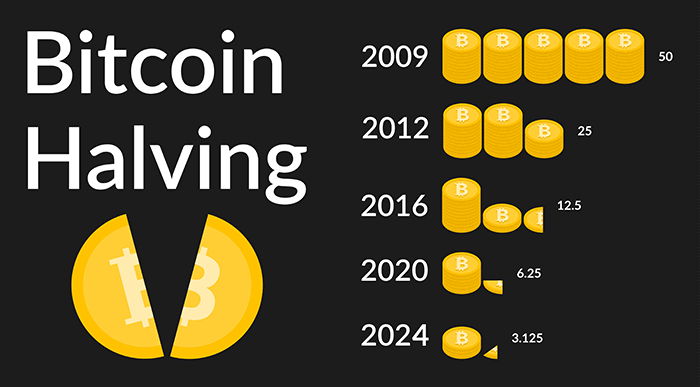

1/3/2009: 50 bitcoins minted for every block produced

11/28/2012: 25 bitcoins minted for every block produced

7/9/2016: 12.5 bitcoins minted for every block produced

5/11/2020: 6.25 bitcoins minted for every block produced

4/2024 (approx): 3.125 bitcoins minted for every block produced

2028: 1.5625 bitcoin minted for every block produced

The estimated date by which all bitcoins will be mined is 2040, and the total number of bitcoins that will have been minted by that date is 21,000,000 (21 million). Once all bitcoins are minted, bitcoin becomes deflationary. That’s when the price is really expected to take off and go to the moon. Why? Less supply and more demand usually means the price goes up.

Have you thought about what happens to miners’ income once all bitcoins have been minted? That question is worth pondering because miners are the backbone of the Bitcoin blockchain. Without them, there’s no one to validate transactions. It’s expected that miners will continue maintaining the blockchain and in return, they’ll get paid transaction fees. These payments will most likely be significantly less than the bitcoin payments they received in the past. It will be interesting to see what happens once all bitcoins are mined.

Bitcoin Halving Chart Analysis

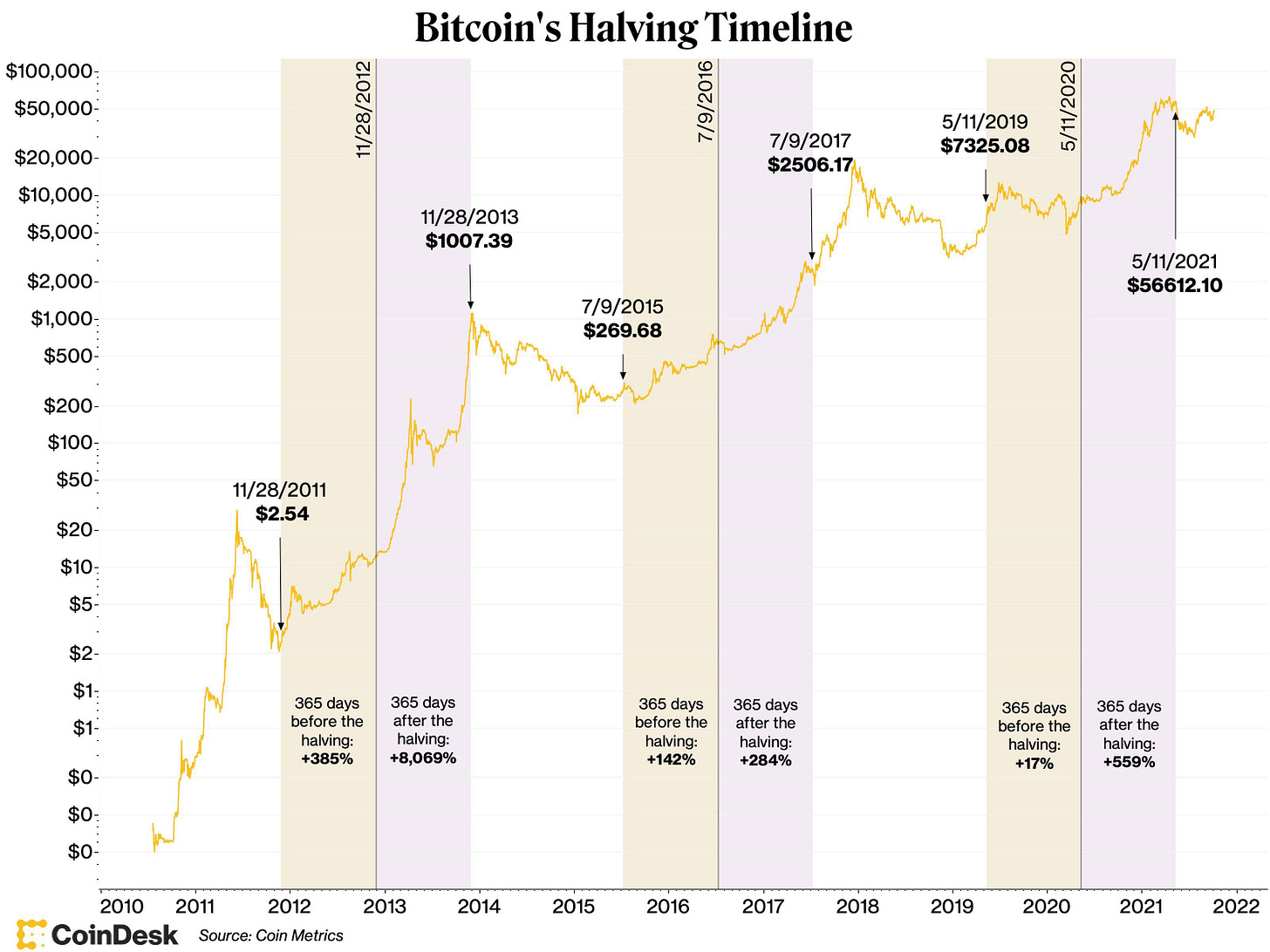

Here’s a chart showing the price movements of bitcoin since the very first halving. Looking closely, you can see that the bitcoin price increased dramatically following each halving. The upward momentum started months before the event in 2 of the last 3 halvings.

Let’s analyze how many days before each halving event occurred that bitcoin’s price started rising. In this following chart, it was very eye-opening for me to see that 365 days BEFORE the halving events of 2012 and 2016, bitcoin began climbing out of its bear market into a new bull run. For the 2020 halving, in my opinion, the upward price movement started only 60 days before the event took place, but some people could argue that it began in January 2019, more than 500 days before the halving date.

What about the next Bitcoin HALVING?

So what does this analysis mean for the next halving event in 2024? While no one has a crystal ball and can’t gaze into the future, we can speculate about bitcoin’s price action in the coming months based on the two charts above.

Here are my observations and assumptions

Before each Halving Event.

First, we note that 67% percent of the time, bitcoin’s price rose significantly 365 days before a halving event.

Second, we observe that bitcoin’s price increased an average of 181% 365 days before a halving event.

After each Halving Event.

Third, 100% of the time, bitcoin’s price rose dramatically 365 days following a halving event.

Fourth, bitcoin’s price spiked an average of 2,971% 365 days after the halving event.

My Plan of Action.

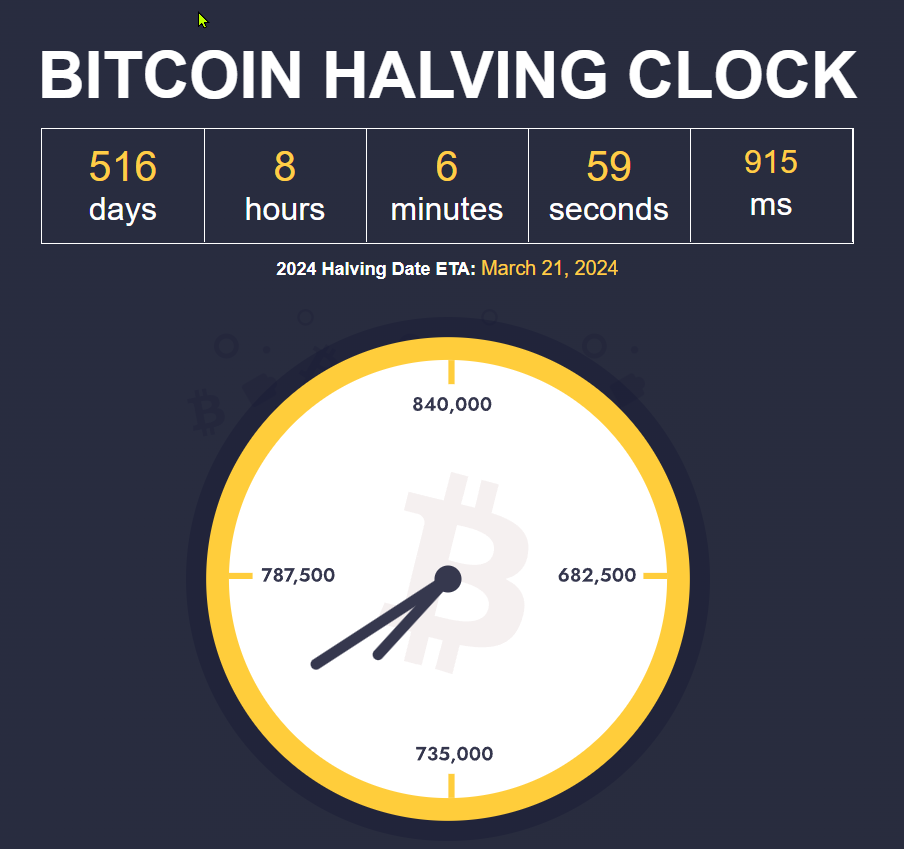

With this information in mind, I am assuming there’s a 67% chance the future price of bitcoin will increase 365 days before the next halving event in 2024. The question is, what’s the date of the next halving so we can set price alerts starting 365 days earlier?

Unfortunately, we won’t know the answer to that question until we get closer to 2024. However, we do know the halving will occur at block number 840,000. The estimated dates I’ve seen calculated from the block number are March 21, 2024, and April 12, 2024.

My Plan BEFORE Next Bitcoin Halving

With that in mind, from now until March 2023, I intend to monitor the prices of the coins and tokens I’m interested in accumulating, then DCA (dollar cost average) into them as prices bottom. I’ll use technical chart analysis to determine good bottom price entry points.

Some of the tokens I’ll buy are for short-term trading. For these, I’ll look for a 100% gain 365 days before the halving. When I reach my target, I will sell them. One token I’m applying this strategy to is RDNT.

Other blue-chip coins like Ether I’ll buy and hodl (hold). I’m watching the markets closely, expecting (hoping) for ETH to dip below $1,000. If it does, I’ll buy some. Then I’ll add those coins to my hardware wallet and wait.

My Plan AFTER Next Bitcoin Halving

Based on my above analysis, prices could skyrocket 2,000%+ up to 365 days after the 2024 bitcoin halving. If the markets perform anywhere near as expected, I will be looking to sell a portion of my ETH holdings during the 365-day period following the 2024 bitcoin halving when the ETH price is 500% above its price on the date of the bitcoin halving.

During the 2024 market rally after the halving, I’ll also be looking to sell several other coins I’m holding. Of course, that’s assuming the rally actually happens. I’ll be looking to sell a large portion of my ADA holdings.

Bitcoin Halving Summary

Thank you for reading my article. I hope you got something out of it and have a plan for your crypto investing future. If you’re unsure how to move forward in creating wealth with crypto, consider signing up on the waitlist for the new Let’s Crypto! Bootcamp training.

To learn more about the Bootcamp, go to my YouTube channel and watch the FREE Pre-Release trainings on each chapter of the Bootcamp.