Hello and Welcome! 👋

Hey there, crypto enthusiasts!

I’m Kelly Sunshawl, and I’m thrilled to have you here in the Life with Crypto community. Whether exploring blockchain’s potential or just dipping your toes into crypto investing, you’re in the right place.

My mission? To help everyday people (like you!) unlock the financial opportunities in crypto while keeping things simple and approachable.

This publication usually goes out by the 10th of the month. However, my family experienced a tragedy - my mother passed unexpectedly.

Here’s what you’ll find in today’s newsletter:

The latest buzz in crypto and blockchain—short and sweet updates you can’t miss.

A deep dive into 2025 insights and forecasts to help you navigate this exciting year in crypto.

An exclusive look at how the Let’s Crypto Mastermind can help grow your portfolio.

And finally, a spotlight on a YouTube video you’ll love, plus other social media gems.

📰 Crypto News Flash 💥

Stay ahead of the game with these four quick updates shaking up the crypto and blockchain world right now:

XLM - New Partnerships - MoneyGram & Fonbnk 🧑🏻🤝🧑🏽

XLM has increased its influence in the industry by forming strategic alliances with MoneyGram and Fonbnk. Its partnership with MoneyGram has enhanced its functionality, allowing smooth cash-to-crypto transfers via USDC. These actions demonstrate XLM’s dedication to integrating blockchain technology with conventional financial institutions.

XLM is also entering Africa through its Fonbnk partnership. This partnership allows prepaid SIM card holders in Africa to access the worldwide digital economy and convert airtime credits into USDC stablecoins.

✍️

U.S. Crypto Banking Monumental Shift 🏦

· The FDIC is considering reforms to support crypto businesses

· Proposed changes could boost institutional crypto adoption

The Federal Deposit Insurance Corporation (FDIC) is facing pivotal decisions that could dramatically impact the banking and crypto sectors in the United States.

Traditionally, the FDIC has sought to “debank” crypto businesses, where banks restrict or deny financial services to companies involved with cryptocurrencies.

In 2022 and 2023, U.S. banking regulators recommended banks curtail their direct activities with cryptocurrencies. However, they did not mandate a complete cessation of banking services for businesses in this sector.

With the onset of the new administration, significant changes in financial regulatory policies are expected. Notable figures like Travis Hill of the FDIC and Michelle Bowman of the Federal Reserve have expressed intentions to decrease regulatory burdens on banks and to promote innovation in the crypto domain.

This shift suggests a more flexible regulatory approach that could reshape the banking and crypto landscapes.

✍️

Solana ETF Prospects in the U.S.💰

Solana ETF approval remains unlikely in the U.S. due to regulatory hurdles and evolving crypto asset classification frameworks.

Canada leads in crypto ETF adoption, making it a strong candidate to introduce Solana-based financial products before the U.S. market.

The possibility of a Solana ETF gaining regulatory approval in the United States remains uncertain. While interest in Solana’s blockchain infrastructure continues to grow, experts believe the regulatory environment is not yet prepared to accommodate such a product.

Unlike the U.S., Canada has demonstrated a more flexible approach to crypto-based ETFs, positioning it as a potential frontrunner for launching a Solana ETF ahead of its American counterparts.

Changes in leadership at the Securities and Exchange Commission could shift regulatory attitudes. The appointment of a new SEC Chair may foster a more crypto-inclusive policy framework.

✍️

Coinbase vs. SEC ruling ⚖️

The recent 3-0 ruling issued by the 3rd U.S. Circuit Court of Appeals was a partial win for Coinbase Global Inc., which went to court after the SEC denied its July 2022 request that the agency clarify how securities laws apply to assets such as cryptocurrencies and tokens.

The recent ruling is highly significant for crypto, with implications that could reshape regulatory frameworks and investor confidence.

Here are the key points regarding its importance:

Demand for Explanation: The U.S. Court of Appeals for the Third Circuit ruled that the SEC must provide a more explicit justification for its previous denial of Coinbase's request to clarify how securities laws apply to cryptocurrencies.

Positive Sentiment: The ruling is viewed as a victory for Coinbase and the broader crypto community, potentially boosting investor confidence.

Setting Precedents: The ruling may set a precedent for other ongoing legal battles within the crypto space, particularly those involving how assets are classified under existing securities laws.

✍️

🔮2025 Crypto Insights and Forecasts 🔮

Crypto is evolving at lightning speed, and 2025 is shaping up to be a watershed moment for blockchain technology. Understanding the trends can help you stay ahead of the curve (and the market 🤑).

Let’s break it down with some predictions that could redefine the space in the next two years:

CBDCs (Central Bank Digital Currencies) Could Go Mainstream 💵

Imagine a world where governments issue digital money—not Bitcoin, but a digital equivalent of your local currency. CBDCs are already being tested in various countries, and experts predict that more nations will join by 2025.

Consider CBDCs the "Netflix of money"—streamlined, on-demand, and centralized. While they won’t replace crypto, they may change how we pay for stuff.

A recent survey indicated that 81% of central banks have either issued or plan to issue a CBDC, with 47% expecting to do so within the next five years.

The European Central Bank (ECB) is in the final stages of preparing for the Digital Euro, aiming to finalize its scheme by October 2025. Similarly, China's Digital Yuan is already in extensive pilot phases and is expected to be fully operational by 2025.

✨News Flash - On May 23, 2024, the US House of Representatives passed H.R. 5403, called the CBDC Anti-Surveillance State Act, which prevents unelected individuals (like the Federal Reserve) from issuing a CBDC.

“The bill requires authorizing legislation from Congress for the issuance of any CBDC—ensuring that it must reflect American values.”

- Chairman McHenry

✍️

The Rise of AI-Powered Blockchains 🤖

Picture blockchain as the brain and artificial intelligence (AI) as the muscle. Together, these technologies are developing faster, more intelligent, and more efficient networks.

In 2025, AI could automate decisions within decentralized finance (DeFi), making them faster and less prone to human error. Imagine a robot managing your portfolio while you sip your morning coffee. Sounds futuristic, right? It may not be as far off as you think. Stay tuned as this narrative develops.

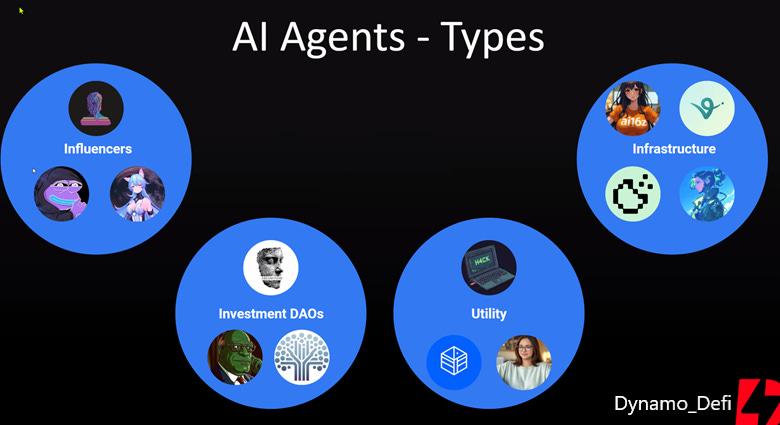

Tip: The AI Agent narrative could be hot in 2025. Check out the Influencer AI Agents—AIXBT, Zerebro, or the Infrastructure AI Agent—Virtuals, ai16z.

(disclosure – I don’t own any of these crypto tokens.)

✍️

Metaverse Integration Becomes Everyday Life 🌐

Remember when the internet was first introduced, and not everyone believed it was necessary? That’s kind of where we are with the metaverse.

However, the convergence of blockchain, artificial intelligence (AI), and the Metaverse is poised to reshape technology and society.

By 2025, blockchain could be the backbone of metaverse economies. Virtual land, digital avatars, and crypto-native marketplaces could become as common as online shopping. Imagine doing your next client meeting not on Zoom but in a fully immersive virtual boardroom.

Regarding investing, non-fungible tokens (NFTs) could enable users to own, trade, and interact with decentralized digital real-world assets.

✍️

Hot Narratives for 2025 Crypto Investing 🌟

Narratives in cryptocurrency refer to the trending ideas, stories, or beliefs that shape how people perceive and value cryptocurrencies. These narratives can influence investor sentiment, market trends, and the adoption of new technologies.

Crypto narratives can change as the market cycle changes, and they can be misleading or harmful if they are based on false assumptions or hype. Therefore, it's essential to critically evaluate narratives and base your investment decisions on sound analysis and research.

With that said, here are some crypto categories I’m watching for my portfolio in 2025.

DeFi & AI (DeFai)

Layer1 blockchains

RWAs

DeSCI

Perpetuals (Perp DEXs)

BTC ecosystem

Why These Forecasts Matter for YOU 🚀

Whether you hold, trade, or stake, these trends will shape the crypto landscape and your portfolio in the coming year.

Stay curious. Stay educated. And most importantly, stay prepared.

What are YOUR predictions for 2025? Hit “Reply” and let me know—I’d love to feature community predictions in a future newsletter!

✍️

🎥Social Media Spotlight 🎥

From Stay-at-Home to Crypto Success 🏠

Have you ever wondered how someone with zero financial background could not only learn crypto but also thrive in it? 🏡💸

In this episode of E.P.I.C. (Everyday People in Crypto) Journeys, I interview an inspiring stay-at-home parent who turned her spare time into serious crypto profits. Their story is packed with tips, real talk, and the mindset shifts that helped her succeed.

Tweet of the Week 🐦

“Crypto isn’t just about making money—it’s about freedom and changing the world. 🚀💡”

Catch more bite-sized insights like this on my Twitter/X feed!

👉Check out the original Tweet here

💡Learn Crypto Like A Pro💡

Ready to take control of your financial future with crypto?

The Let’s Crypto Mastermind is your ultimate guide to turning crypto curiosity into serious investments. Whether you're just starting out or looking to sharpen your strategy, our step-by-step framework makes it easy to go from zero to crypto hero.

Here’s the best part: You don’t have to figure it out alone. We’re with you every step of the way—through live Money Monday Webinars, Deep Dive Q&A sessions, Quick Guides, Trainings, Community support, and more.

Step 1: Assess Risk 🧐

Before diving into crypto, it’s vital to understand your investor profile. Are you a risk-taker or more cautious?

With our free Quick Guide, you’ll:

Discover your risk tolerance with a simple, guided assessment.

Learn how to set realistic goals based on your finances and lifestyle.

Start building confidence in your investment decisions.

Step 2: Get Involved 🚀

It’s time to take action! In this step, we help you buy your first crypto with fiat money and select 2–3 strategies to match your goals. Whether you're into trading or passive income through DeFi, our Mastermind will teach you how to:

Navigate crypto exchanges with ease—even if you’re a total beginner.

Choose simple starter strategies to grow your portfolio.

Avoid common mistakes that cost new investors time and money.

Still not convinced?

Here’s a screenshot of what one of our Let’s Crypto! Members, Jason B., had to say:

And here’s what another Let’s Crypto! Member, Sarah L., had to say:

"I had no idea where to start with crypto. The Mastermind gave me a clear path and the confidence to invest. Thanks to this program, I turned $1,000 into $6,000 in about 18 months!"

Here’s a screenshot of Jerry S’s comment about our Deep Dive Community Call.

What are you waiting for? Join the Let’s Crypto Mastermind now and start building your crypto future.

Thank you for reading!

If you've read this far into the newsletter, you’re a crypto enthusiast!

Stay curious and keep learning.😊