A sunny welcome to our crypto adventure ☀️

Hey there, crypto friends! 😊

I'm thrilled to have you join us for another exciting edition of our newsletter. Today, we're diving into some fascinating crypto trends and a special report that I can't wait for you to explore. Whether you're sipping your morning coffee or unwinding after a long day, let's embark on this journey together and uncover the thrilling world of cryptocurrency.

In this edition, we're shining a light on the cutting-edge trends that are shaping the crypto landscape in 2025.

From AI's growing influence to the rise of real-world assets (RWA), there's plenty to keep your curiosity piqued.

Plus, I'll share my latest insights in a special report on the intriguing bifurcation of the crypto universe—trust me, it's a topic worth delving into!

Lastly, I’ll give you a sneak peek into the Quick Guides available to our MasterMind Plus Plan members.

Before diving into the nitty-gritty, let me share a little story from my crypto journey. Back when I first started investing in crypto, I often felt like an explorer navigating uncharted territories. There were moments of triumph and, yes, a few twists and turns along the way. But each step taught me something invaluable, and I hope to pass on that wisdom to you in this newsletter.

So, grab your favorite beverage, get comfy, and let's dive into an issue filled with insights, intrigue, and a sprinkle of fun. 🌟

📰 Leading Crypto News🌐

1️⃣ AI, DePIN, and RWA lead 2025 crypto trends

Imagine a world where AI and blockchain join forces like a dynamic duo, reshaping how industries run. In 2025, AI-driven tokens are doing just that, particularly in supply chain and finance sectors. These tokens, like Fetch.ai, create a decentralized network of smart agents working together to simplify complex tasks. Think of it as a digital symphony, with AI as the conductor! 🎶

Meanwhile, DePIN, or Decentralized Physical Infrastructure Networks, is bridging the digital and physical worlds. Helium (HNT) is a prime example, using blockchain to enhance real-world infrastructure—kind of like adding Wi-Fi to your entire city block.

And let's not forget Real World Assets (RWA). ONDO is taking the lead, bringing assets like U.S. Treasuries on-chain. This trend offers a fresh way to engage with traditional finance and crypto alike, opening new doors for savvy investors.

✍️

2️⃣ Crypto market volatility amid token unlocks

March 2025 told a tale of volatility with large-scale token unlocks shaking the market. Projects like SUI released a whopping $180 million in tokens, adding quite the hurdle for investors to jump. But don't fret—Binance is bouncing back strongly. After facing regulatory hiccups last year, they've implemented transparency measures and are seeing growth in Asian markets. It's like watching a phoenix rise from the ashes.

And here's some good news for DeFi lovers! After a brief nap, DeFi is wide awake. With lending platforms and DEXs buzzing, the Total Value Locked (TVL) on Ethereum, Solana, and Arbitrum networks shot up by 10–15%. It's like the DeFi party is back, and everyone's invited. 🎉

✍️

3️⃣ Bitcoin and Ethereum face macro challenges

The economic winds have been tricky for Bitcoin and Ethereum this quarter. Bitcoin took a 12% dip in the first quarter, and Ethereum tumbled by a whopping 45%, marking one of the steepest quarterly declines in recent years — all while ETF outflows hit record highs. It's like being caught in a financial storm without an umbrella.

Bitcoin saw an 11.5% drop in mining revenue, while Ethereum faced debates over its economic model. Yet, amid the turbulence, a silver lining appeared—Ethereum has enjoyed a surge in new wallet creation. It's proof that folks are still keen to be part of Ethereum's journey, despite the rough seas.

✍️

4️⃣ Bitcoin’s Balancing Act Amid Tariff Tensions 🎢

In a year brimming with political drama, Bitcoin has proven itself to be a sturdy ship in the stormy seas of 2025. Imagine a tightrope walker gracefully navigating the high wire of market volatility—this is Bitcoin, holding its own despite the gusty winds of President Trump’s tariff policies.

In April this year, Bitcoin took a nosedive to $74,400, marking its lowest point of the year and a sharp 30% drop from its January highs. It was like watching your favorite underdog team trailing at halftime—nerve-wracking yet exhilarating. This plummet was mainly due to a global "risk-off" sentiment as investors reacted to the escalating trade tensions between heavyweight economies like the U.S. and China.

Interestingly, Bitcoin's movements began to mirror those of traditional markets. Its correlation with equities climbed to a moderate 0.47 by March. Yet, unlike a fair-weather friend, long-term Bitcoin holders stayed loyal, maintaining their positions and signaling a robust belief in Bitcoin’s worth as a non-sovereign treasure.

Despite geopolitical tension from U.S. trade tariffs, Bitcoin proved its mettle in March 2025. The price only dipped by a smidge (0.61%), but the on-chain activity soared. Transactions rose by 6%, and active wallets rose by 15%. It's like Bitcoin flexing its muscles, showing it's still got what it takes.

Investors' faith in spot Bitcoin ETFs grew, with outflows dropping compared to February. Ethereum, however, faced more challenges, struggling with an 18.4% price drop. It's a tale of two cryptos, each writing its own story in the face of global dynamics.

✍️

📚 Special Report 📚

The bifurcation of crypto: two paths, one future 🧩

Imagine you're standing at a crossroads where the digital realm of crypto is splitting into two distinct paths. Welcome to the era of crypto bifurcation.🚦

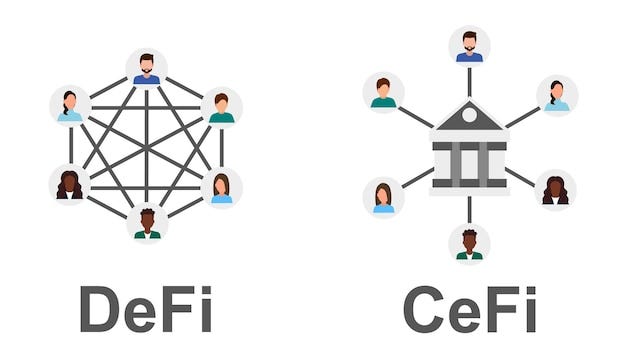

In 2025, we're witnessing a pivotal moment in the crypto world—two parallel highways are emerging. On one side, we have Decentralized Finance (DeFi), the wild west of finance, where control is spread among the users, much like a bustling bazaar. Picture DeFi as a thriving metropolis with no central authority, filled with innovation and the spirit of self-governance.

On the other side, there's CeDeFi—a hybrid model blending DeFi's freedom with the organized structure of Centralized Finance (CeFi). Imagine it as a sleek, modern city where skyscrapers of centralized oversight stand tall, offering the stability that some folks prefer.

Both paths offer unique experiences and opportunities. DeFi is empowering for those who love the idea of complete control, but it comes with its own risks, like navigating a dense forest without a map. Meanwhile, CeDeFi provides a smoother journey, akin to driving on a well-paved highway, with guardrails offering a sense of security.

Now, you might ask, "Which path should I take?" Well, it really depends on your comfort level and goals. As someone who has been immersed in this evolving landscape since 2015, I can tell you that neither path is inherently better—it’s about what suits your journey.

Here's what I foresee: As these paths evolve, we'll see an intricate dance between autonomy and security. DeFi will likely remain the playground for the adventurous, while CeDeFi might appeal to those eager for both innovation and peace of mind.

The beauty of this bifurcation? You don't have to choose just one. Like a buffet, you can sample both and decide what suits your taste.

As crypto continues to evolve, I encourage you to stay curious. Embrace the unknown like an explorer charting new territories.

And remember, in this ever-changing landscape, you’re never alone. We're in this adventure together. So, let’s keep the conversation going. Share your thoughts, and let's navigate these pathways as a community. 🌟

✍️

🎓 Steps to Success 🎓

Unlocking Your Crypto Potential: Let's Crypto MasterMind Quick Guides 🚀

Embarking on a crypto journey can feel like setting sail on uncharted waters. But fear not! Our Let's Crypto MasterMind Quick Guides are your trusty compass, ready to steer you through the waves of wealth-building opportunities.

These guides are designed with you in mind, offering a treasure trove of insights that cater to both the curious newcomer and the seasoned pro. Whether you're keen to assess risk like a savvy navigator or eager to learn DeFi with the precision of a seasoned trader, our guides have got you covered.

Here's a sneak peek at what you can explore:

Assess Risk: Learn how to gauge your risk profile and make informed investment decisions. Think of it as your personalized crypto safety belt.

Get Involved: Ready to dive in? Discover ways to engage with various crypto strategies that fit your risk profile and keep you ahead of the curve.

Be Secure: Protect your treasure with tips on protecting your crypto assets from digital pirates.

Learn Trading: Navigate trading charts like a pro with strategies that demystify the market's ebb and flow and give you an edge.

Learn Defi: Follow my simple but profitable strategy for earning passive income with crypto. Your digital piggy bank awaits you!

Track Profit: Keep your eye on the prize with methods to monitor your gains and optimize your portfolio. Hint: I provide members a handy spreadsheet they can use.

Find Gems: Would you like to find the next big crypto winner before everyone else does? If you follow my Seven Steps to Finding Gems, you just might!

Crypto Taxes: No one likes taxes, but wouldn’t it be helpful to have a handy ebook guide so you know what you’re doing? You're in luck! Our quick guide on crypto and taxes includes five ebooks!

But wait, there's more! Our Let's Crypto! MasterMind community is where the magic truly happens. It's a bustling hub of like-minded explorers eager to share their knowledge and learn from one another. By joining, you'll gain access to exclusive resources, insightful discussions, and the chance to connect with fellow crypto enthusiasts.

So, why wait? Dive into our Quick Guides and discover your path to crypto success. Together, we'll turn curiosity into confidence and ambition into achievement. Let's navigate this exciting world of crypto—one guide at a time. 🗺️

Ready to set sail? Your crypto adventure awaits!

✍️

Thank you for reading! 😊 I hope you enjoyed the content. If you want me to cover a topic in a newsletter or blog post, reply to this email and let me know.

Bye for now! See you next month!

Stay curious and keep learning. 🙌